We invite everyone to discuss the draft law in your social networks. We look forward to receiving suggestions for improving this project via email at info@belarusforum.org.

Justification for the adoption of the Law on the National Welfare Fund of the Republic of Belarus

The need to raise the welfare of the citizens of the Republic of Belarus to the level of developed countries;

Redistribution of income from the export of natural resources and the privatization of enterprises for the benefit of the citizens of the Republic of Belarus, which can be directed towards the construction of individual housing, education, or health;

The demand to reform the state pension system, which in its current form is merely an additional method of withdrawing citizens' earnings;

The creation of a highly efficient economy, the integration of Belarusian enterprises into international labor division, significant wage growth, and improved working conditions.

The establishment of the National Welfare Fund is based on the best practices of creating sovereign and pension funds in Europe, America, and Asia. Special attention during the drafting of the Law was paid to the operations of the Norwegian Welfare Fund, which generates revenue from oil and gas exports, and the Chilean Pension Fund, which receives income from the export of copper, lead, and tin. All income from the export of natural resources is evenly distributed among all citizens of the Republic of Belarus, instead of being deposited in state accounts, after which they are uncontrollably spent or end up in the pockets of oligarchs associated with the regime. The experience of national funds from Singapore, Qatar, and the United Arab Emirates was also used for the development of this draft Law.

For the management of the Fund, all national assets are transferred. They are conventionally divided into several categories:

a) natural resources;

b) natural monopolies;

c) state enterprises;

d) municipal enterprises.

a) Natural resources. Companies in this group, which includes potassium fertilizer producers, forest, chalk, peat, and other natural minerals, cannot be privatized. The income from the export of this group is credited to the fund's account and is evenly distributed among all shareholders - citizens of the Republic of Belarus. Management companies for these industries are selected on a competitive basis and only for a specific period. They also invest in modernization, attract loans under their guarantees, and receive a fixed portion of income determined by an open competition.

b) Natural monopolies. Companies in this group include Minsk-2 Airport, Belarusian Railways, Belavia Airlines, Beltelcom, Beltransgaz, Belneftekhim, and others. To develop these companies, either an investor or a management company is involved. In the investment model, the profit margin is agreed upon, the investor transfers the enterprises to the Fund's management. After that, the mechanism works as in the case with group a companies. In other words, part of the income is received by the operator, the main income goes to the fund, which is distributed among shareholders, that is, citizens of the Republic of Belarus.

c) State enterprises. The list of these companies is approved by the Fund's Management Board. Companies in this group are fully privatized. Revenues are credited to the Fund's accounts and fully distributed among its shareholders, that is, the citizens of the Republic of Belarus.

d) Municipal enterprises. Companies in this group are sold by local government authorities, and the funds from their sale go to the local authorities and are used to develop infrastructure - building roads, local bridges, school repairs, supplying sewage and electricity to small settlements, building Community Centers.

USE OF FUND’S RESOURCES.

Every shareholder has access to their account and can see in real-time how this account is being replenished as the above-mentioned property is sold.

The fund's resources cannot be cashed out. You cannot sell your share, but you can pass it on by inheritance. The Fund's resources can be used for investment. Every citizen has the right to invest the funds on their account in housing construction, education, and healthcare. Part of the funds is reserved for pension payments and cannot be used until the retirement age is reached. Upon reaching retirement age, a portion of the fund's share will be sold in the shareholder's interest, and this money will be credited to their account monthly, which they can use without restrictions.

The fund's management, in collaboration with the citizens of the Republic of Belarus, is tasked with searching for the tens of billions of US dollars stolen during the existence of the dictatorial regime and returning them to the country. The discovered funds are credited to the Fund's accounts and are evenly distributed among the citizens of the Republic of Belarus.

Persons who identify these funds in the foreign accounts of the former dictator, his children, and front men are entitled to a reward. Its volume will be determined by the fund's management.

The Fund's Board has the right to invest in private commercial and industrial facilities, stocks, gold both domestically and abroad. Investing the Fund's resources in American and European stock markets will allow diversifying investment risks and making every Belarusian part of the global economy. Having foreign stocks at the disposal of Belarusians will prevent the emergence of demagogues and populists on the political arena.

Pensioners from this source will receive additional pension payments, allowing a gradual transition in our country to an individual accumulative pension system, more efficient than the current "redistributive" one, where pensions are paid by taxing those currently working.

ENSURING A DECENT EXISTENCE

For 15 years, Belarusians were promised a salary of 500 dollars. These promises were not meant to come true. If this program is implemented, within 5 years after the regime change, Belarusians will be able to reach an income level of at least 4-5 thousand dollars per month:

Firstly, it will consist of salaries, which will rise to 1-2 thousand dollars equivalent. Reaching this level at enterprises of the machine-building, instrument-making, and microelectronics industries is a realistic task within the first five years.

For instance, the salary level of a worker at a machine-building plant in the Republic of South Africa is about 2,000 US dollars. The average salary level at the Hynex company, owned by a South Korean investor engaged in chip design, was 6,000 dollars.

Secondly, from the income derived from our country's natural wealth – the export of potash salts, peat, timber, chalk, and other natural resources;

Today, they formally legally belong to the state. But in essence, the only owner and manager of all the natural wealth of the Republic of Belarus was one person. The aim of this law is to distribute all income obtained from natural resources not in the interest of one citizen or a group of oligarchs close to him but in favor of all citizens of the Republic of Belarus.

Thirdly, from the income obtained from the program of company privatization and their entry into international production and sales chains.

It must be acknowledged that there is not a single well-known company in the world that belongs to the state. From Apple, Google to Tesla, BMW, Toyota, or Hyundai – none is state-owned. State enterprises cannot be efficient. Firstly, they cannot attract investments, as investment is the investment of financial resources in exchange for a stake in equity. Secondly, the director of a state enterprise has no right to make mistakes. If three projects are implemented at a state enterprise, one successful and two unsuccessful, the director will be sent to jail. Therefore, there is not a single state enterprise that has invented something new. Managers of state enterprises don't take risks, don't innovate, but just copy already working samples. As a result, the profit is minimal, and the salaries of workers and engineers are miserable.

Our major plants need to be integrated into existing conglomerates. This is a global trend. Entering into large conglomerates reduces the purchase cost of components, allows standardizing standards, makes the product more quality and more competitive. That's why Volkswagen merged with Audi, then with Porsche, then the group includes Seat, Skoda, Lamborghini, Bentley. Renault merged with Nissan and Mitsubishi. A single alliance was formed by Opel, Peugeot, Alfa Romeo, Chrysler, Fiat, Maserati, Jeep, and Citroën.

There is no reason why BelAZ could not form an alliance with Komatsu, MAZ with Caterpillar, MTZ with John Deere, Gomselmash with Case New Holland, Claas, and so on. Merging with large international conglomerates and their entry into our companies' equity will enable their effective modernization, restore the competitiveness of Belarusian technology, and significantly increase the salaries of enterprise employees. This will help catch up in technological development, gain access to the latest engineering developments, buy components cheaper. This will make Belarusian industrial products better in quality and lower in price. The international reputation of traditional brands will be restored.

ELIMINATION OF THE FSZN (Fund of Social Protection of Population).

Throughout the world, pension funds are funds intended for making pension payments due to old age or disability. They are divided into public and private. However, in developed countries, it is challenging to see the difference. This is because both are subject to stringent regulation; undergo thorough checks, the results of which are openly published. They are active participants in the securities market, but they can only invest in reliable, well-secured assets. The essence of these funds' activities is to ensure people receive pensions higher than if their money were deposited in a bank.

The so-called Population Social Protection Fund of Belarus is not a pension savings tool, but another way to take money from citizens.

The regime fears that if people receive their entire salary and then give away half as income tax and FSZN contribution, they might start questioning how the funds are utilized. We are talking about significant amounts of money for individuals. Suppose a Belarusian receives $500 in hand monthly. That means you earn $1,000 a month. Annually – $12,000. But even from this meager amount, the state takes half - 13% income tax + 36% contribution to FSZN. In other words, out of the earned $12,000, $6,000 goes to unknown authorities!

Now let's look at the activities of the Belarusian FSZN and see where and for what purposes we are remitting our money. Employers and employees contribute 36% of their salaries to this Fund. Employers contribute 35%, while employees give 1%. 29% goes to pension provision, and 7% to medical services.

Now, let's do the math.

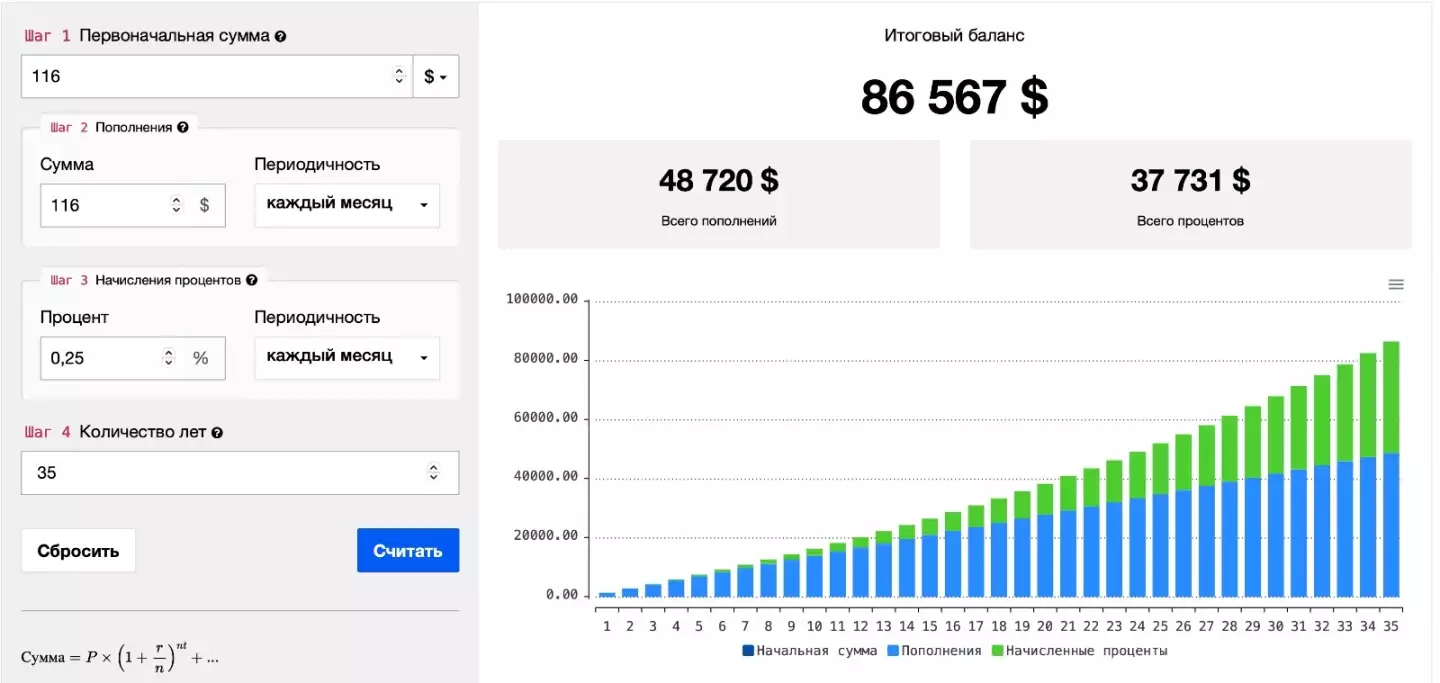

On average, a person works for 35 years. Assuming an average salary in the country of $400 (although Lukashenko has promised $500 for more than 11 years), it means they remit approximately $116 monthly to their pension.

Our pension savings take the form of a non-revocable bank deposit. In banks, such a deposit might be untouchable for, say, a year, but a pension account cannot be accessed before reaching retirement age. Suppose these funds are deposited in a bank at a minimal rate of 3% per annum.

Below, we provide a calculator where everyone can independently calculate how much an average Belarusian citizen should have in their account by the time they retire, given the minimal bank deposit rate.

That amounts to $86,567. That is, this is the amount that a citizen has saved up by the time of retirement.

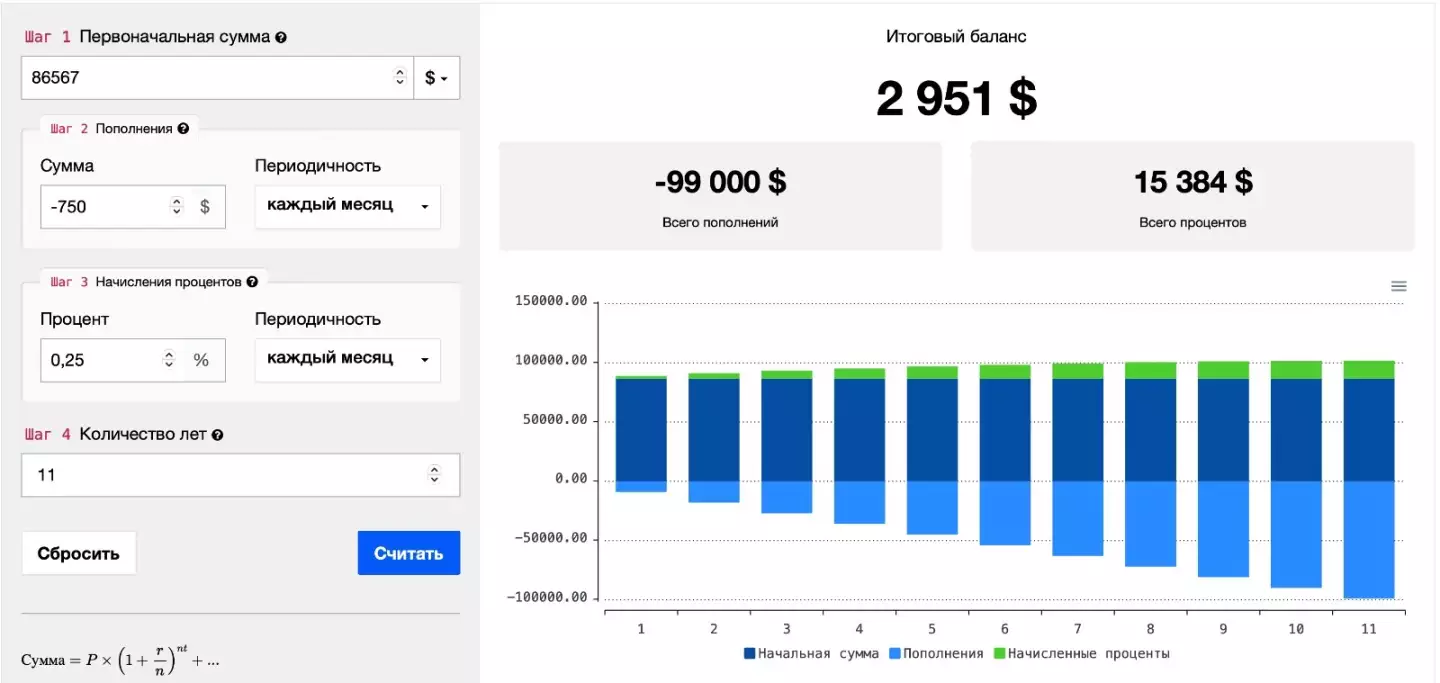

Our contributions have the nature of a non-revocable deposit. That is, we pay money all our lives, but we can only start using them upon reaching retirement age. We cannot withdraw them all at once, and we receive monthly payments. That means the bank interest continues to accrue on them. Let's calculate. The average life expectancy in Belarus is 73 years. So, this amount should be divided over 11 years or 132 months.

That amounts to $750. Plus, there's almost another $3,000 in residuals that can theoretically be passed on to the spouse or children. This should be the average pension in the Republic of Belarus. However, currently, it stands at about $180.

Thus, it is not an exaggeration to say that the Belarusian Social Protection Fund is not only the most inefficient in the world. This could be explained by the economic incompetence of the country's leadership. The problem is that it essentially operates as a thieving mechanism. Meaning, even if the state did nothing, invested nowhere, and just put pension provisions in the bank, it could pay pensions three times more than the current payments.

Where does the difference go? Towards agro-towns where no one wants to live? To maintain morally and technologically obsolete enterprises that require more and more financial assistance and still end up dying? Like what happened with Motovelo Factory, Vityaz, Volna, and hundreds and thousands of other enterprises that were once the pride of the national auto and instrument-making industries? Or on sham parades, meaningless "sports festivals," building new residences, and buying expensive cars?

In reality, the main purpose of the SPF is, under the guise of paying pension contributions, to serve as an additional source of extraction of money earned by Belarusians.

The proposed bill also includes a reform of the pension system. Every citizen is issued a social insurance card. It has an accumulative nature. That is, all the money credited to a worker's pension account is reflected as a specific amount of money. At any moment, he can check the balance of his personal account.

Such a system won't allow the arbitrary extraction of funds from citizens' pension savings! With it, every citizen will see how much money they have accumulated for their pension, just as they know how much money is in their bank account.

In this case, there's no need to increase the retirement age, as it was done in our country. A person will determine how much longer they want to work after turning 60 years old (for men). Here's how it works: Let's assume I have saved up $86,000 in my pension account. If I retire at 60, my pension will be $700 per month (the calculation above was based on a retirement age of 62). However, if I continue to work for another five years and receive the country's average salary, my savings start to grow exponentially, and the expected lifespan post-retirement decreases. My savings over the five years would be $108,000. Retiring at 65, I would receive a pension of $1,120.

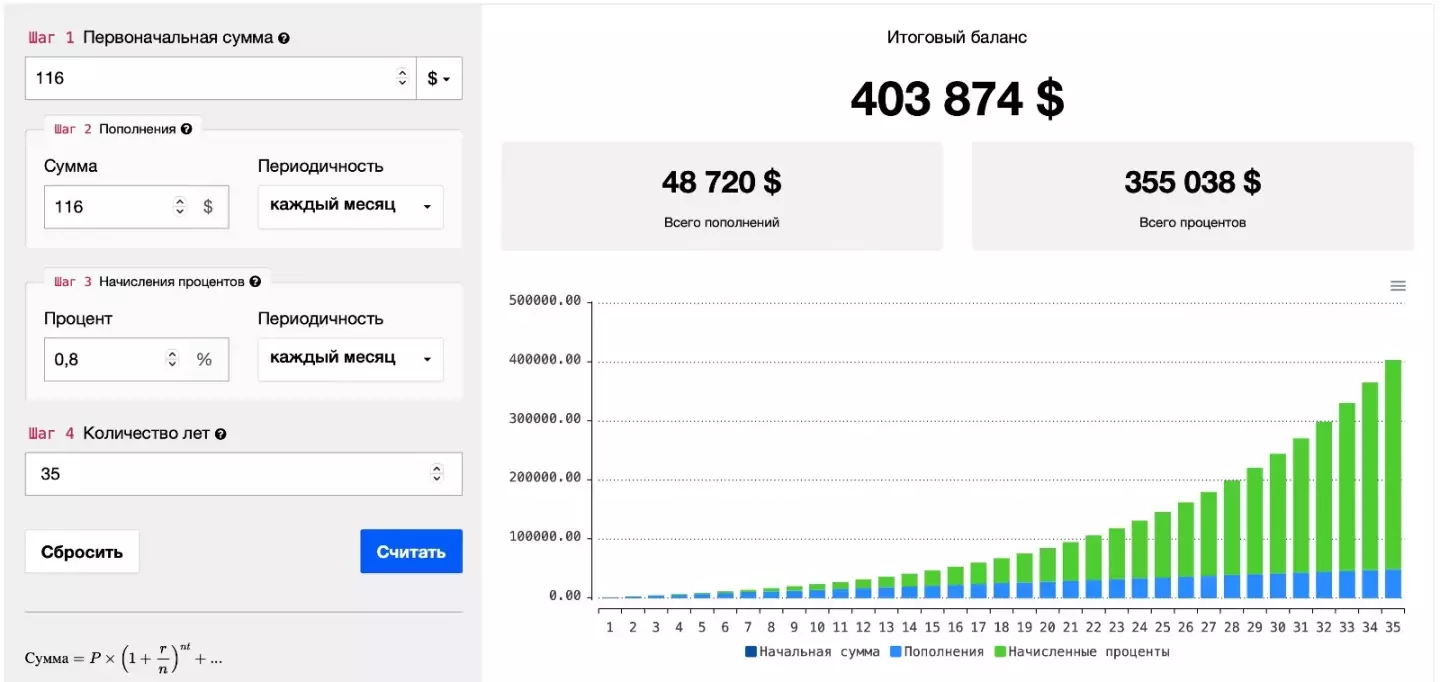

But this is based on a 3% return – there are no funds in the world as inefficient as the Belarusian SPF. We won't look at the leaders, the so-called buffer funds that invest in over-the-counter assets. Their profitability can be very high, as, for example, the Swedish fund AP6, which has a 46.2% annual return. As it specializes in high-risk off-exchange operations, we'll set it aside. We won't even consider numerous leaders providing a 20% capital increase per annum. For the sake of argument, let's use an average rate of 10%, like the Norwegian government's Norway Government Pension Fund has, and apply it to Belarus with pension deductions of $116. Let's see the calculations:

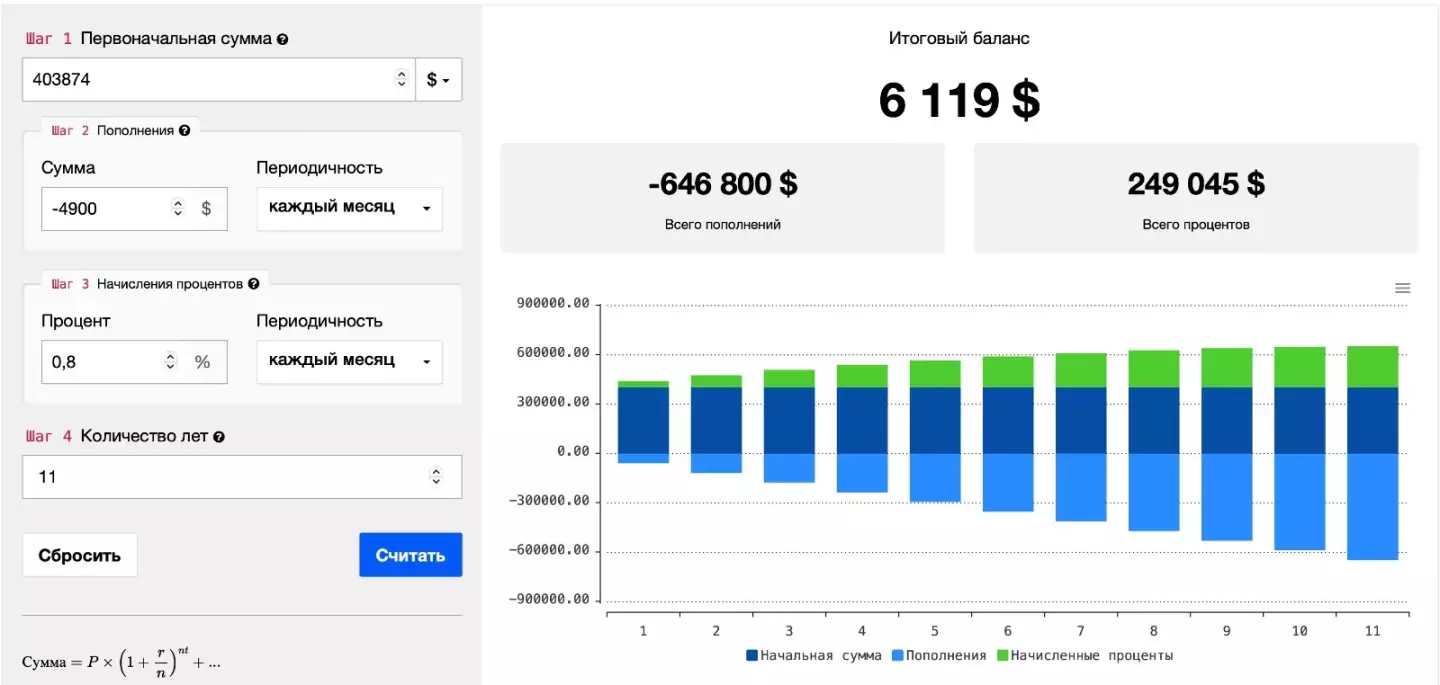

We see that the average Belarusian worker, in this case, could have saved up to 400,000 dollars for retirement. After reaching the official retirement age, they start receiving their pension. Let's look at their pension:

This means that their pension amounts to 4900 dollars per month.

It is worth noting that the calculations provided above are simplified and are based on straightforward assumptions. In practice, many factors, such as inflation, changes in the labor market structure, global economic crises, and others, can influence the final size of pension savings and payouts.

Of course, we must also make adjustments for the different retirement ages of men and women. It should also be taken into account that such high figures, compared to, say, Iceland, where the average pension is about 2,000 dollars per month, are due to the fact that men there live on average 10 years longer than in Belarus. That is, the expected life expectancy in Iceland after retirement is not 11, but 21 years. And in the West, the working career typically starts later than in Belarus, at least by 2-3 years.

When the money from the export of natural resources and the shareholding of enterprises starts flowing into the personal accounts of Belarusians, which they can use for the construction of comfortable housing, education, and healthcare, the quality of their life will significantly improve. Belarusians will spend more time on education, consequently starting their working careers later. They will adopt a healthier lifestyle, engage in physical culture and sports, drink less or consume higher quality alcoholic beverages, smoke less, travel abroad more often, and the average lifespan will increase. In other words, the duration of the working career will significantly decrease, life expectancy will increase, and, accordingly, pension payments will decrease.

But even with the most conservative estimates, if the pensions of Belarusians will range from 1 to 2 thousand dollars per month, then we will consider the pension reform in the Republic of Belarus successful.

And no individual, no matter how much power they have, will be able to dip into the pockets of Belarusians and take away their pension savings. Belarusians, like other successful peoples of the world, have the right to a secured life and a dignified old age.